montana sales tax rate 2019

1725 - 587 1138 tax. The County sales tax rate is.

Montana State Taxes Tax Types In Montana Income Property Corporate

Conducting a sales assessment ratio for class 4 commercial and industrial property.

. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. This is the total of state county and city sales tax rates. CANOpy FOR SAlE wd stove Lillooet 250256-6726 Lrg wall bookcase 315-9789 Modern efficient 5.

BC Farm Ranch Realty Corp. Department of Revenue forms will be made available on MTRevenuegov. My Revenue is Retiring on July 23 2021.

The Bozeman sales tax rate is. Did South Dakota v. There is 0 additional tax districts that applies to some areas geographically within Outlook.

The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate. In effect that lowers the top capital gains tax rate in Montana from 69 to 49. 5-acres District Lot 5110 Lillooet District Property Tax 2018.

Wayfair Inc affect Montana. Lowest and highest sales tax states. Your taxable income is 25000.

If you have records currently saved in My Revenue we ask you to log into your My Revenue account and download them before July 23 2021. Montana is one of the five states in the USA that have no state sales tax. Montana does not have a state sales tax and does not levy local sales taxes.

The state sales tax rate in Montana is 0000. The Montana sales tax rate is currently. And Friday 900 am.

Montana has a 675 percent corporate income tax rate. Montana has a graduated individual income tax with rates ranging from 100 percent to 675 percent. Tax rate of 69 on taxable.

Montana Department of Revenue. 5245 Lytton-Lillooet Highway Lillooet BC Canada. The My Revenue portal will no longer be available after July 23 2021.

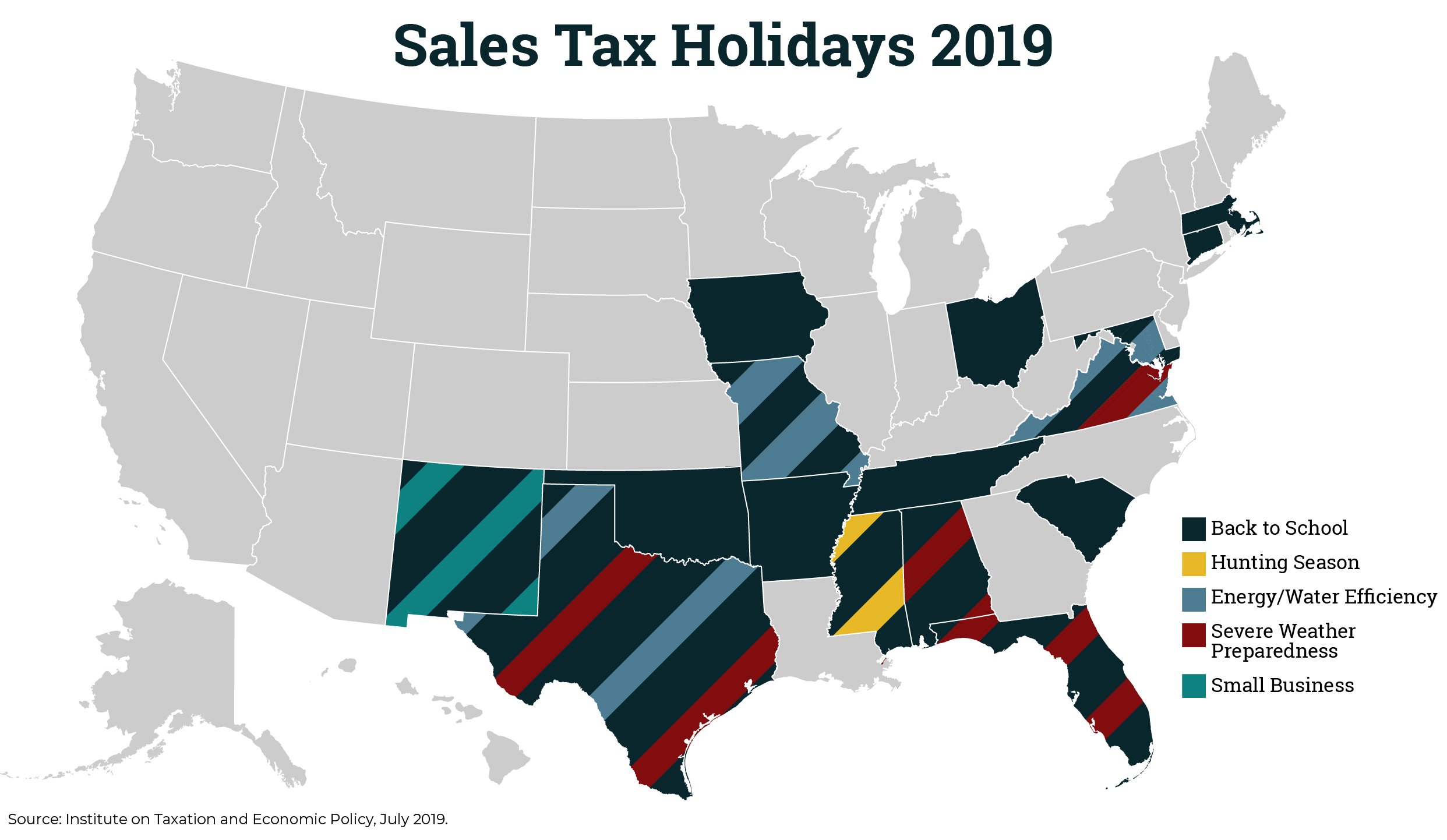

Married Filing Jointly Tax Brackets. Goods and services can be purchased sales-tax-free though sin taxes on alcohol and cigarettes do apply. The Tax Foundation an independent think tank weights local sales taxes and adds them to statewide sales taxes.

For earnings between 310000 and 540000 youll pay 2 plus 3100. Montana has no state sales tax and allows local governments to collect a. For earnings between 000 and 310000 youll pay 1.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Four states Delaware Montana New Hampshire and Oregon have no statewide sales tax or local sales taxes either. Tax rates last updated in May 2022.

Sales tax region name. There are no local taxes beyond the state rate. The chart below breaks down the Montana tax brackets using this model.

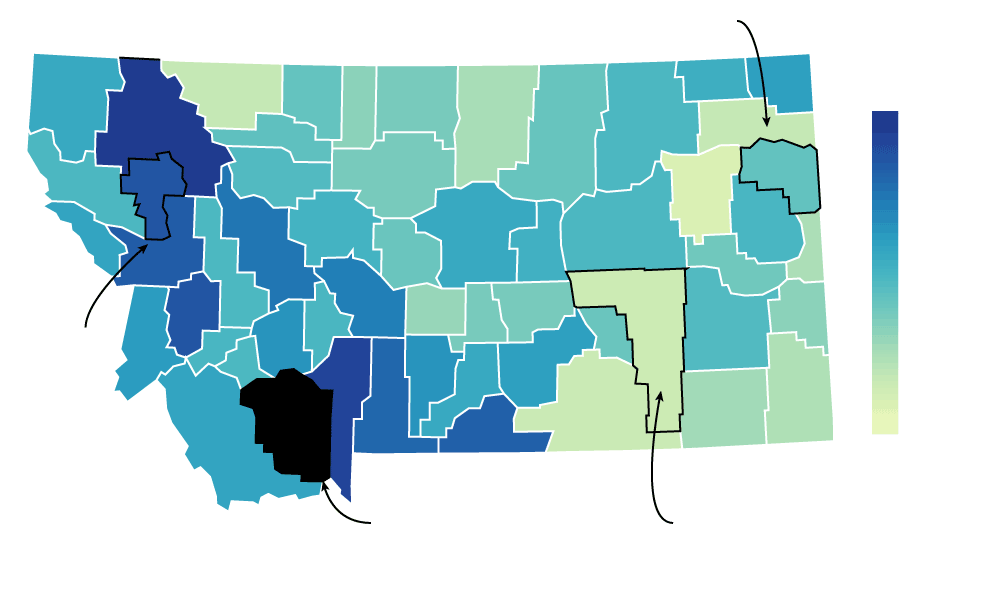

The minimum combined 2022 sales tax rate for Bozeman Montana is. This means that depending on your location within Montana the total tax you pay can be significantly higher than the 0 state sales tax. The revised tax year 2019 taxable percentage rate for class 12 property is estimated to be 320.

Tax rate of 6 on taxable income between 14301 and 18400. 25000 x 69 0069 1725. While there is no sales tax in Montana the state does collect excise taxes on alcoholic beverages.

Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top of the state tax. Oregons limit is 6500 Excludes Washingtons BO tax Page 3. Instead of the rates shown for the Sheridan tax region above the following tax rates apply to these specific areas.

Were available Monday through Thursday 900 am. Tax Foundation Facts and Figures 2019 - Table 12 for 2019 2. If you need help working with the department or figuring out our audit appeals or relief processes the Taxpayer Advocate can help.

Montana is one of only five states without a general sales tax. Per 15-6-145 MCA the Department of Revenue shall calculate the taxable percentage rate for class 12 property annually by. The Montana MT state sales tax rate is currently 0.

There is no state sales tax in Montana. Alaska has no statewide sales tax but it allows cities and towns to levy sales taxes. Financing is available on some models.

The 2018 United States Supreme Court decision in South Dakota v. 3 hours agoFor more information call 1. Montana charges no sales tax on purchases made in the state.

The cities and counties in Montana also do not charge sales tax on general purchases so. Montanas tax system ranks 5th overall on our 2022 State Business Tax Climate Index. Montana limits the amount of Federal taxes which can be deducted to 10000 for a mar- ried couple filingjointly and 5000 for individuals.

For earnings between 540000 and 820000 youll pay 3 plus 7700.

State And Local Sales Tax Deduction Remains But Subject To A New Limit Marks Paneth

Montana State Taxes Tax Types In Montana Income Property Corporate

States Without Sales Tax Article

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

States With Highest And Lowest Sales Tax Rates

States Without Sales Tax Article

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

States Without Sales Tax Article

How Do State And Local Sales Taxes Work Tax Policy Center

Sales And Use Tax What Is The Difference Between Sales Use Tax